WINDHOEK, Jan. 22 (Xinhua) -- The Bank of Namibia's (BoN) latest data showed Namibia's net FDI inflows decreased on an annual basis during the third quarter of last year.

The central bank recorded much lower inflows of 1.62 billion Namibia dollars (about 117 million U.S. dollars) in the third quarter of 2018 compared to 4.12 billion Namibia dollars which was recorded during the same quarter in 2017.

BoN attributed the FDI deterioration mainly to lower reinvested earnings and reduced borrowing by FDI enterprises.

The current trade situation globally will likely dampen Namibia's expected recovery in foreign direct investment (FDI) in 2019, according to financial planning and advisory services, PSG Wealth Management in a report on Tuesday.

According to PSG, the third quarter of 2018 was also associated with a general decline in commodity prices, reduced emerging market sentiment and a slowdown in global FDI inflows, while the Namibian government also scored some own goals in this time, in terms of investor-unfriendly policies.

"While commodity prices have started to recover somewhat since 2016 and Windhoek has recently scrapped some unfavorable policies and policy proposals to lure back foreign investment," PSG added.

Meanwhile the central bank said the country's FDI stock in the third quarter of last year was mainly concentrated in the sectors of mining and quarrying (66 percent), financial intermediation (26 percent), wholesale and retail trade (3 percent) and manufacturing (2 percent).

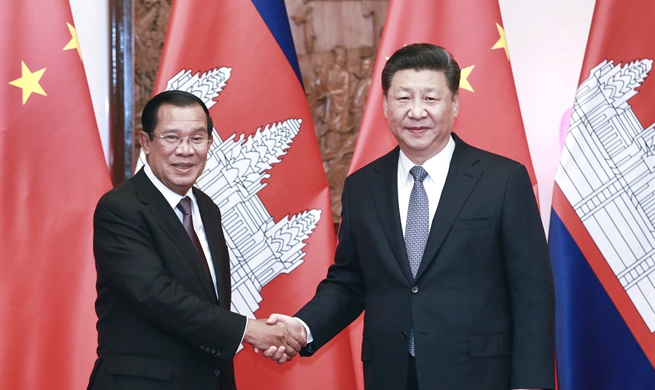

According to the central bank, China, South Africa and Mauritius accounted for about 77 percent of the FDI stock at the end of the third quarter of 2018.